nebraska sales tax percentage

A sales tax table is a printable sheet that you can use as a reference to easily calculate the sales tax due on an item of any price - simply round to the nearest 020 and find the row in the. The County sales tax rate is.

Historical Nebraska Tax Policy Information Ballotpedia

6 rows The Omaha Nebraska sales tax is 700 consisting of 550 Nebraska state sales tax.

. Department of Revenue Current Local Sales and Use Tax Rates. In addition to taxes car purchases in Nebraska may be subject to other fees like registration title and plate fees. Nebraska Non-motor Vehicle Sales Tax Collections by County and Selected Cities 19992020 Annual Non-motor Vehicle Sales Tax Collections Monthly Non-motor Vehicle Sales Tax.

Free Unlimited Searches Try Now. Did South Dakota v. Ad Get Nebraska Tax Rate By Zip.

The Ord Nebraska sales tax is 700 consisting of 550 Nebraska state sales tax and 150 Ord local sales taxesThe local sales tax consists of a 150 city sales tax. Nebraska has a 55 statewide sales tax rate but also has 295 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 055 on. Nebraska City 20 75 075 16-339 33705 Nehawka 10 65 065 240-340 33740 Neligh 10 65 065 91-341 33775 Nelson 10 65 065 80-342 33880 Newman.

There are a total of 334 local tax jurisdictions across the state. Motor Vehicle Tax Calculation Table MSRP Table for passenger cars vans motorcycles utility vehicles and light duty trucks wGVWR of 7 tons or less. The Nebraska state sales tax rate is 55 and the average NE sales tax after local surtaxes is 68.

535 rows Nebraska has state sales tax of 55 and allows local governments to collect a local option sales tax of up to 2. The Nebraska NE state sales tax rate is currently 55. Current Local Sales and Use Tax Rates and Other Sales and Use Tax Information.

While many other states allow counties and other localities to collect a local option sales tax Nebraska. Nebraska collects a 55 state sales tax rate on the purchase of all vehicles. The Nebraska sales tax rate is currently.

Counties and cities in Nebraska are allowed to charge an additional local sales tax on. 31 rows The state sales tax rate in Nebraska is 5500. Wayfair Inc affect Nebraska.

Depending on local municipalities the total tax rate can be as high as 75 but food and prescription drugs are exempt. The Ord Sales Tax. Download all Nebraska sales tax rates by zip code.

Nebraska Sales Tax Rate Finder. A Base Tax set in Nebraska motor vehicle statutes is assigned to the specific MSRP range and motor vehicle tax is then. The Omaha sales tax rate is.

With local taxes the. Free Unlimited Searches Try Now. The Sidney Nebraska sales tax is 750 consisting of 550 Nebraska state sales tax and 200 Sidney local sales taxesThe local.

Ad Get Nebraska Tax Rate By Zip. The Oneill Nebraska sales tax is 550 the same as the Nebraska state sales tax. Form Title Form Document Nebraska Tax Application with Information Guide 022018 20 Form 55 Sales and Use Tax Rate Cards Form 6 Sales and Use Tax Rate Cards Form 65.

The 2018 United States Supreme. ArcGIS Web Application - Nebraska.

Nebraska Sales Tax Rates By City County 2022

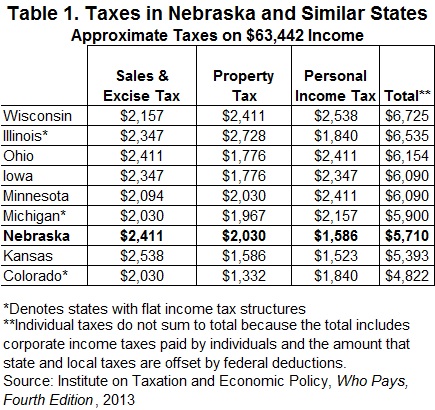

Policy Brief Typical Family Pays Less Tax In Nebraska Than In Most Similar States Open Sky Policy Institute

Taxes And Spending In Nebraska

New Budget Analysis Highlighted Facebook Invests In Nebraska Office Of Governor Pete Ricketts

Removing Barriers In Nebraska Part Three How Our Taxes And Spending Compare

Taxes And Spending In Nebraska

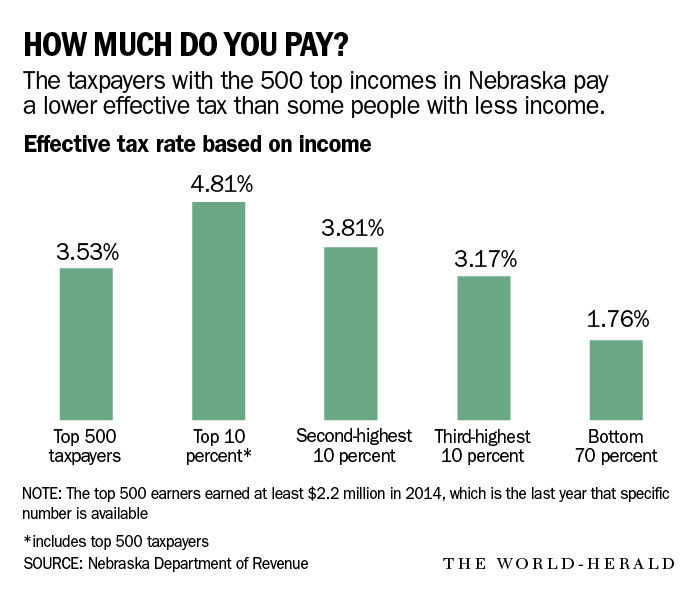

Hansen Want Lower Nebraska Property Taxes We Need To Have A Chat About Income Taxes Archives Omaha Com

Nebraska Taxes At A Glance Open Sky Policy Institute

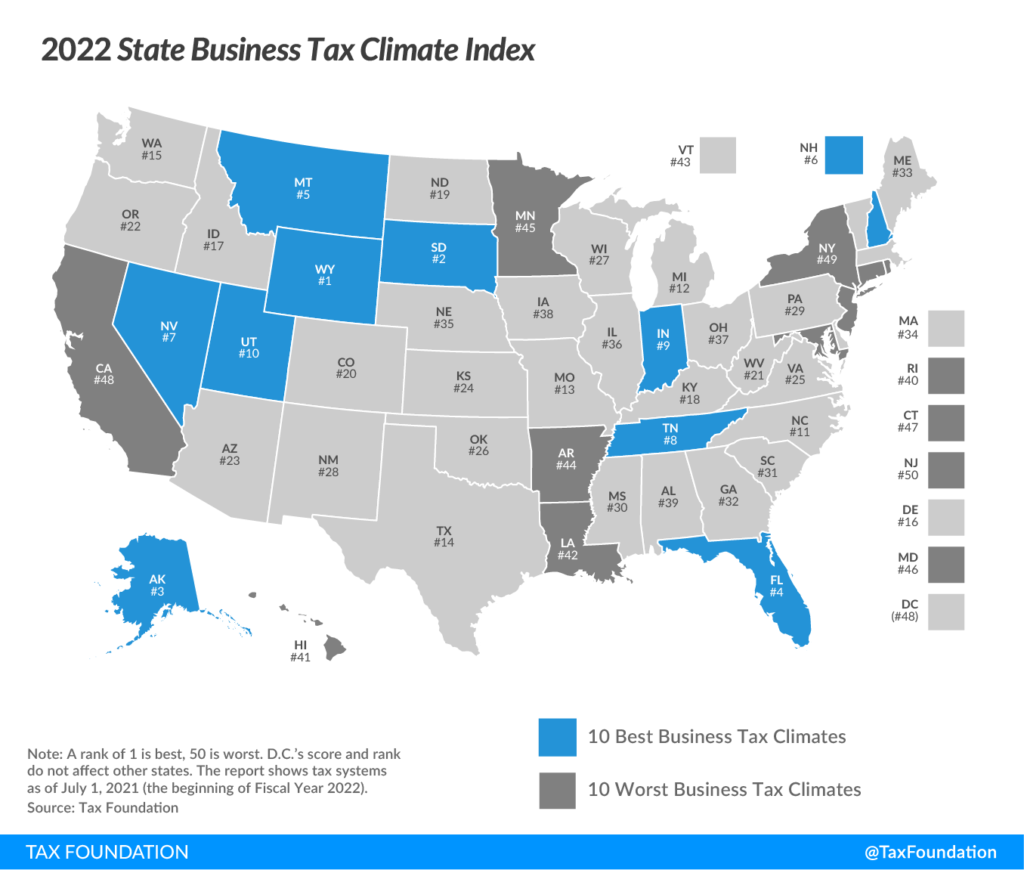

Nebraska Drops To 35th In National Tax Ranking

Taxes And Spending In Nebraska

Taxes And Spending In Nebraska

Policy Brief Typical Family Pays Less Tax In Nebraska Than In Most Similar States Open Sky Policy Institute

Nebraska Sales Tax Small Business Guide Truic

Taxes And Spending In Nebraska

Proposed Bill Would Add New Income Tax Bracket In Nebraska Kptm